Accounts Payable & Receivable Control

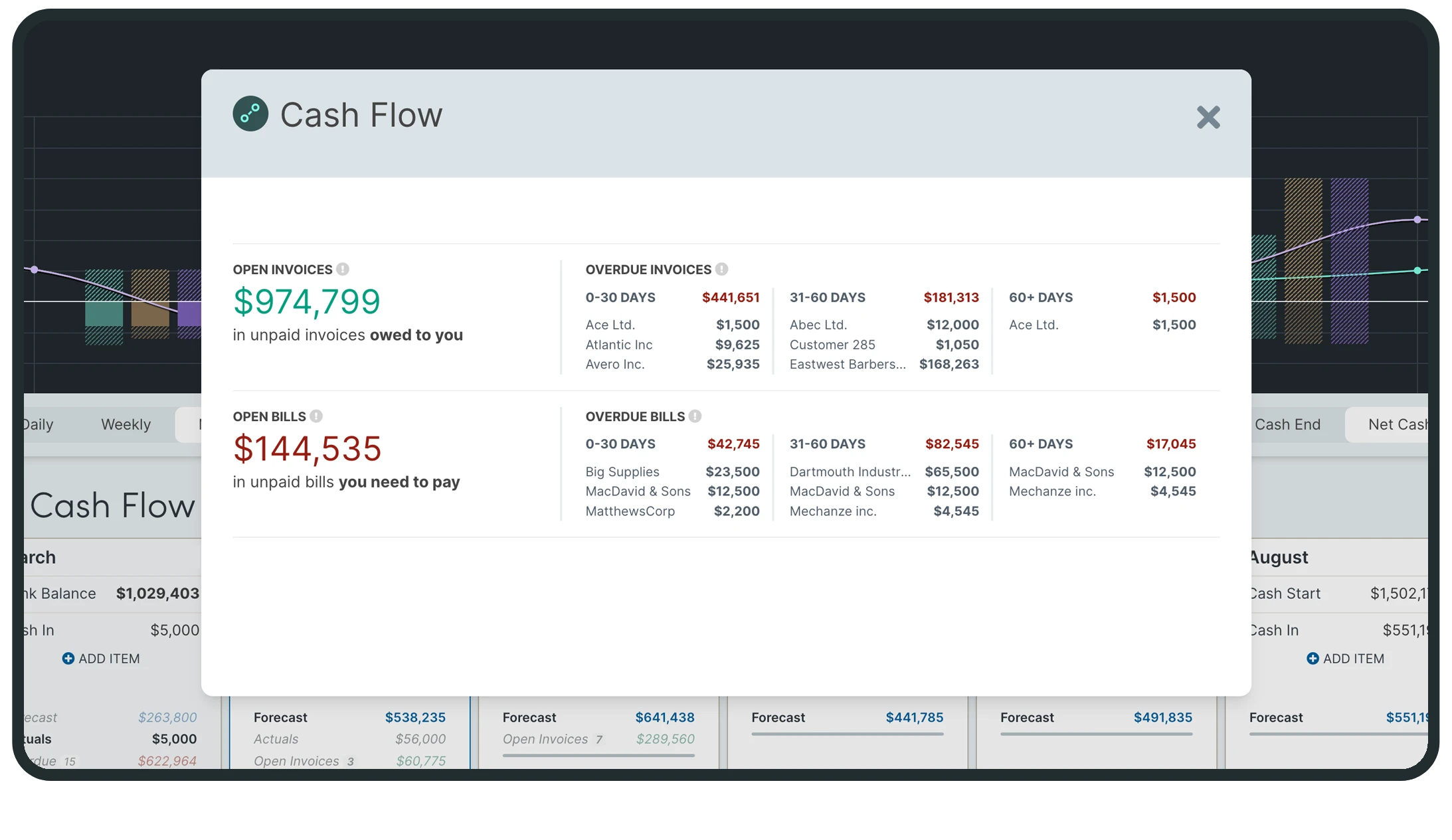

Full Cash Flow Visibility

See all of your invoices and bills on a timeline to visualize your true cash flow.

Realistic Cash Flow Forecasts

Move invoices and bills to 'expected' dates to bring reality to your forecast.

Cash Flow Automation

'Bump' Overdue Items to Today

Never miss an overdue invoice or bill. Dryrun can keep auto-move them to keep them front and center.

Intelligent Payment Tracking

Dryrun watches for payments, even partial ones, and updates your forecast accordingly.

Team Cash Management

Keep Everyone in the Loop

Use 'Action Lists' and Notes so everybody is in-the-know.

Cash Flow at a Glance

See what's changed and where everything is at with clear color coding.