Sales forecasting is the process of estimating your business’s future sales or revenues. At first, this can sound like a confusing and overwhelming task, but with some application it can be accomplished relatively easily. Forecasting sales is the process of identifying and understanding underlying assumptions and drivers of sales and ultimately implementing and managing them.

It can be confusing initially because there are many models and methods of forecasting sales, not only qualitatively but quantitatively. Fortunately, complex models are typically not needed. Although it is impossible to predict exact sales in the future, sales forecasting is crucial for financial projection and enabling smart business decision making in order to grow your company.

What to be aware of when sales forecasting and modeling?

Forecasts and contingency plans must be prepared for incidents far beyond the control of the business. These incidents can have untold consequences for its operation.

Although sales forecasting is crucial, it should never be treated as the sole factor for a business decision. If sales projections fall short, firms can incur significant losses and lose market share.

If results from a specific event or time period are disappointing, in lieu of blaming the forecast, a thorough investigation is necessary to determine how all factors of the business contributed to the disappointment.

Forecasting models are dynamic and, therefore, should be continually updated when conditions change. Furthermore, sales forecasts are interdependent with a company’s overall strategy. Forecasting models need to be continually updated when conditions or strategies change.

Why are sales forecasting and modeling important for success?

It is important to note that today's forecast is tomorrow's cash!

When your business runs out of cash and isn't able to obtain new finance, it will go out of business. Due to the ease of creating cash flow forecasts, businesses have no excuse not to see a cash flow crisis coming, barring some astronomical event.

Cash flow forecasts are important for many reasons, including:

- Identifying current or potential future cash shortfalls

- Enables you to predict potential cash shortfalls so they can be avoided

- Ensuring you have enough cash to pay employees and suppliers in order to continue business

Profits can't be generated without cash flow. You need cash flow to pay your employees and suppliers so that they can produce your goods and services. And it's the sales from your goods/services that generate a profit.

How to be disciplined about financial planning.

Financial planning is imperative. You must be disciplined and know what (and when) money is coming in and going out of your business. A robust cash flow forecast will ensure that your business is fit to deal with any challenges and issues which may come your way.

Further, if you are ever in a situation where you must request a loan from the bank, they will require a detailed cash flow forecast before even considering giving any money.

Use forecasting to spot the signs of potential cash flow problems.

In cash flow forecasting, it is crucial to not only know what you are doing but also address any cash flow issues you might have as soon as possible.

If you have minor cash flow problems, you're not going to disappear by themselves. If you have severe cash flow issues, you may need to take different measures… you’ll need to go from "tightening the belt" to taking out a loan. If a forecast is available and easy to understand, it will save you a lot of headaches moving forward.

If you’ve had cash flow issues in the past and are in profit, you just need to tighten your credit control measures, reduce your costs, or perhaps consult with your bank. More serious cash flow issues require more drastic measures and an immediate timeline.

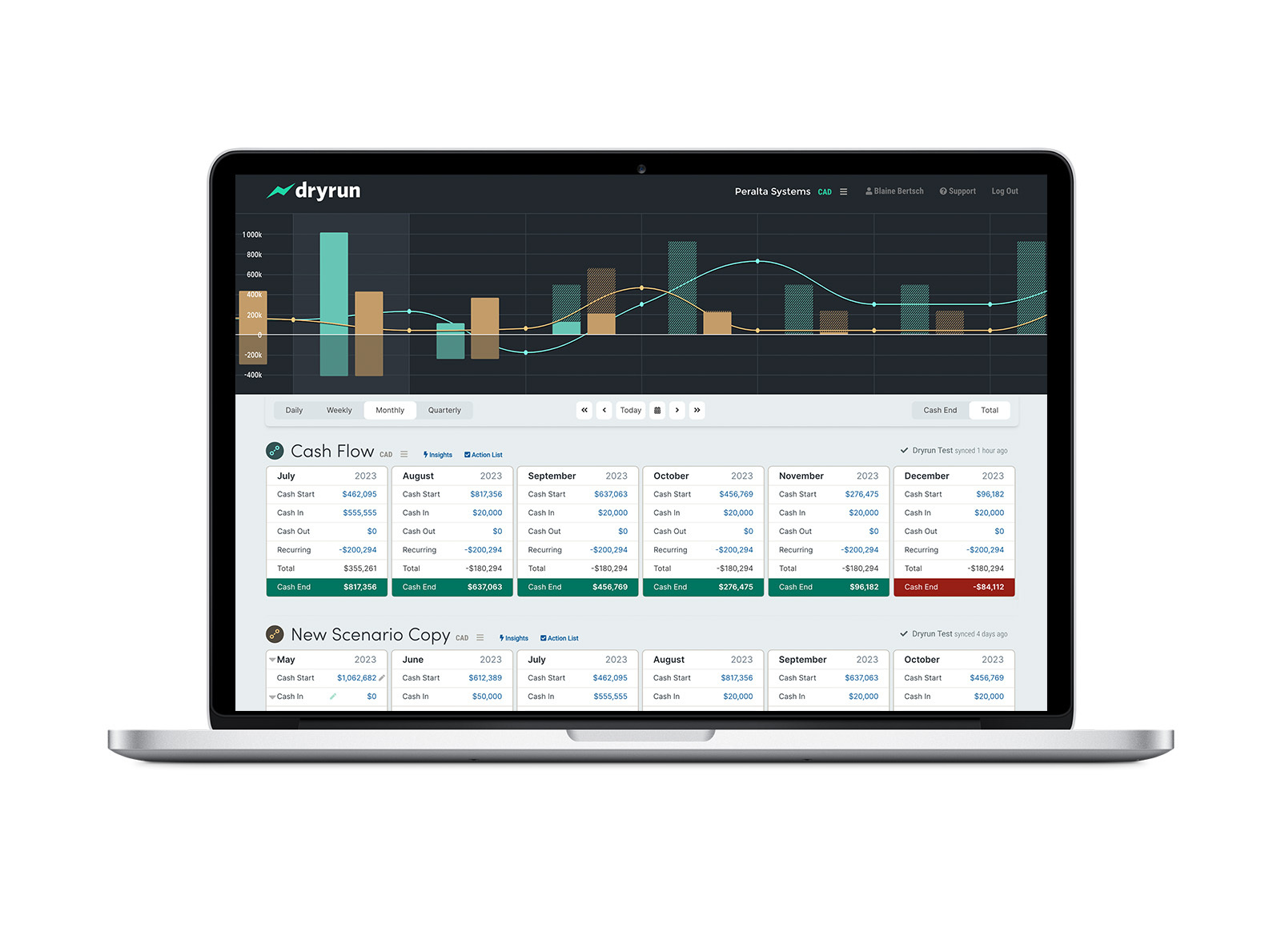

With software like Dryrun, cash flow forecasting and financial modeling is easy to do on your own. Linking to your accounting software allows for easily digestible models and predictions to be completed and interpreted on a whim.

Dryrun will help free up your valuable time by running evaluations and generating these forecasts, instead of spending hours manipulating spreadsheets and jumping between screens of accounting software.

Ensuring that your forecast is exactly tailored to your business’ specific needs is crucial for your financial success.

__

Forecast Your Cash Flow, Revenue and Profit in the Ultimate Scenario-Modelling Tool to gain confidence, clarity and insight into your business.

Dryrun ties automation with unmatched flexibility delivering clear, powerful and accurate forecasts in a fraction of the time spent in spreadsheets.

Book your DISCOVERY CALL to learn about the Dryrun advantage or start your FREE TRIAL today!

Dryrun - A better way to run the numbers.