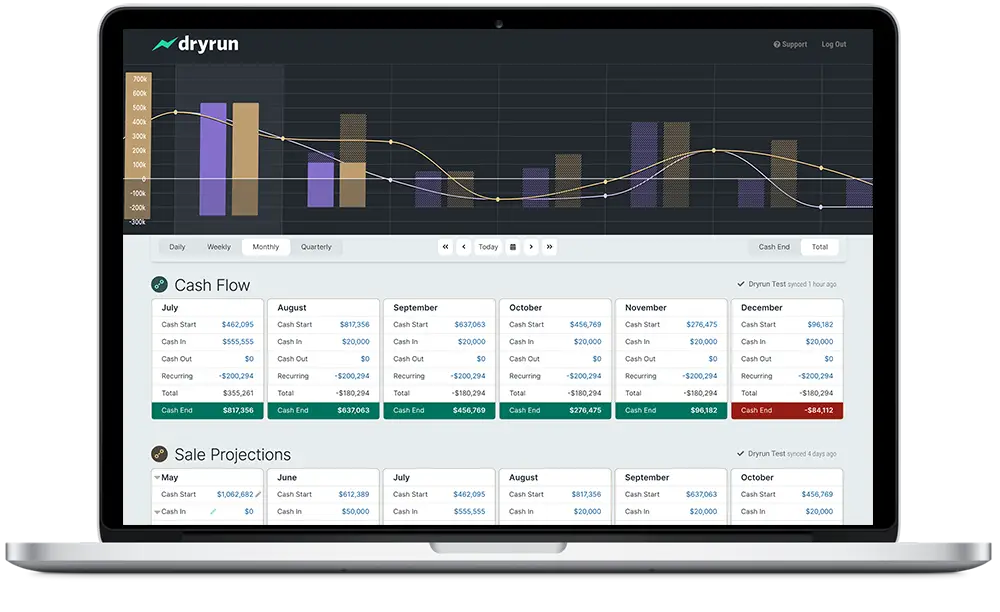

Instant intelligence with epic control.

Software to forecast cash flow, model scenarios & share budgets with a seamless blend of simplicity, automation and control.

What are your biggest cashflow needs?

Free yourself from spreadsheets

Introducing Dryrun. Automatic & flexible.

- Hours are wasted building and updating spreadsheets

- Spreadsheets are difficult to read and explain

- They start simple but grow out of control

- Over 80% of spreadsheets contain errors

Video by long-time Dryrun customer, Guy Bauer. Read his story.

True cash flow visibility.

Forecast, manage and model your finances.

Make decisions that grows revenue, boosts profit & cuts costs.

- Our import wizard will get your data the way you want it in minutes.

- Unmatched manual control means you can model anything.

- Visuals are clear and collaboration is easy

The perfect solution for finance pros.

Save hours and crystal clear deliver insights.

Leave spreadsheets behind and make the most of your valuable time.

- Sophisticated forecasts in minutes, not days.

- Visuals that management teams love.

- Automation with unmatched flexibility.

Trusted by businesses everywhere:

Your Cash Flow Forecasting Software

Join thousands of users in 70 countries.

Conversations with finance pros and business owners the world over.

Part of Your Community

Many minds have helped us build Dryrun.

- Intuit $100k App Showdown

- Top 32 Fintech App Featured at Sibos

- AICPA/CPA.com Accelerator

- Intuit Prosperity Accelerator